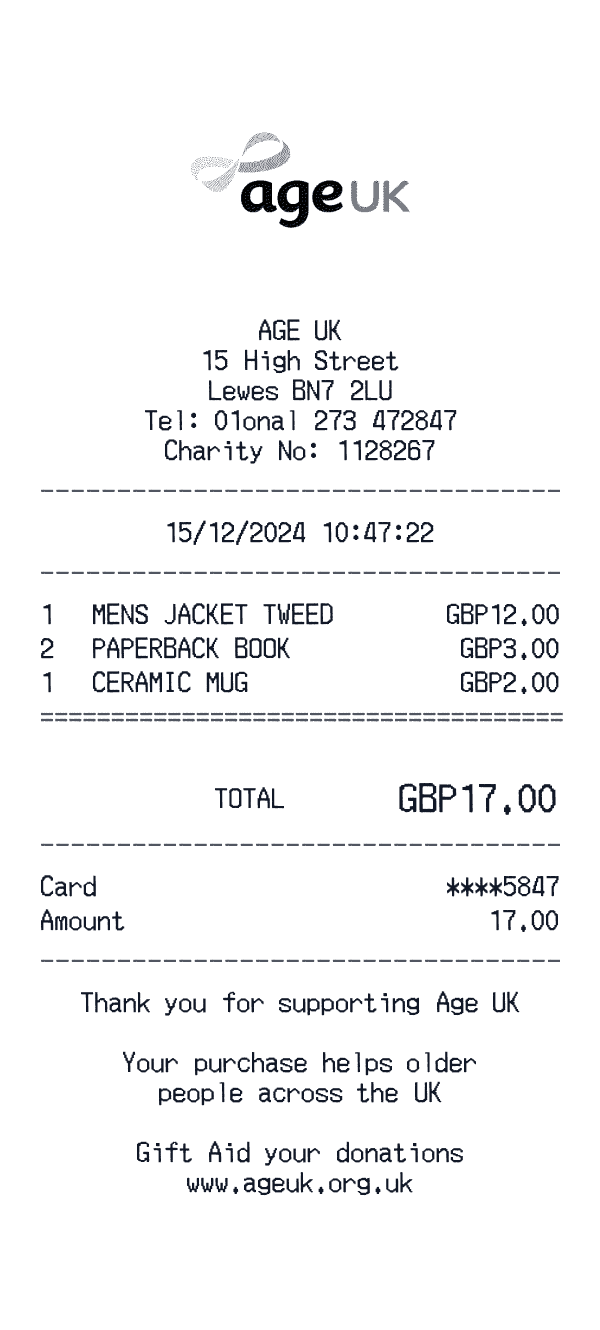

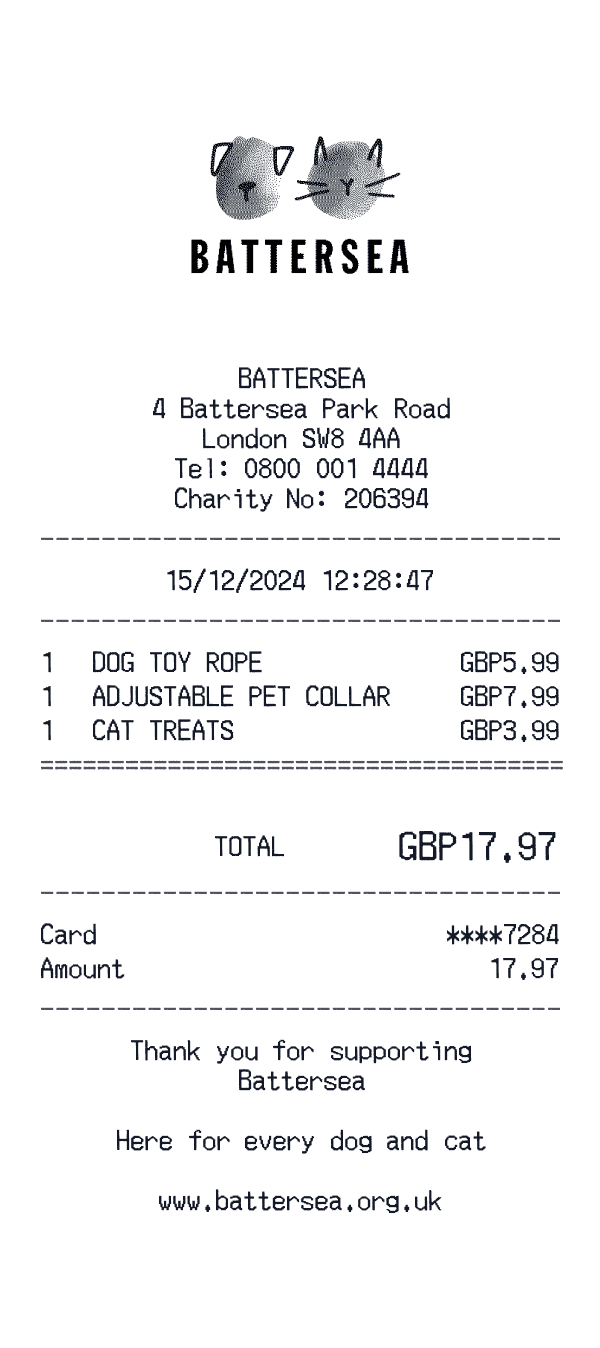

Create realistic donation receipt props

Need a donation receipt for your film production, theater set, or creative project? Our donation receipt template creates authentic-looking mockups featuring nonprofit acknowledgment formats. Perfect for scenes involving charitable giving, fundraising galas, or character development showing a philanthropic side.

Donation receipts are recognizable documents that can add depth to storytelling. A stack of charity receipts can characterize someone as generous, a single large donation receipt can be a plot point in a mystery, or a fundraising gala receipt can set the scene for an upscale event. These props add authenticity to contemporary and period-appropriate productions.

How to create a donation receipt mockup

Start by entering your fictional or generic nonprofit organization name, address, and contact information. Create a charity that fits your story—an animal shelter, arts foundation, medical research fund, or religious organization. Add donor information and contribution details to match your scene.

Customize the donation amount, date, and type (cash, check, goods) to fit your narrative. Include thank-you messaging for authenticity. Download the completed receipt as a high-resolution image ready for your production.

Popular uses for donation receipt mockups

Film and TV productions use donation receipt props for character development and plot devices. A character's charitable giving history can reveal personality traits. A suspicious donation receipt might be evidence in a mystery. Fundraising event scenes require realistic props to sell the setting.

Escape room designers incorporate donation receipts into puzzle sequences—the organization name might be an anagram, or the donation amount could be a code. Game developers and novelists use them for reference and worldbuilding. UI/UX designers create donation receipt mockups when prototyping nonprofit fundraising platforms or charity apps.

Customization options

Our donation receipt template offers extensive customization for your creative vision. Create fictional nonprofit organizations with custom names, missions, and branding. Adjust donation amounts and dates to fit your storyline. Add realistic thank-you messaging and acknowledgment language.

For period-accurate productions, research typical donation amounts and nonprofit names from different eras. A 1960s scene might feature different charitable organizations than a contemporary setting. These details add production value and authenticity to your creative work.