EasyReceiptMaker is an entertainment tool

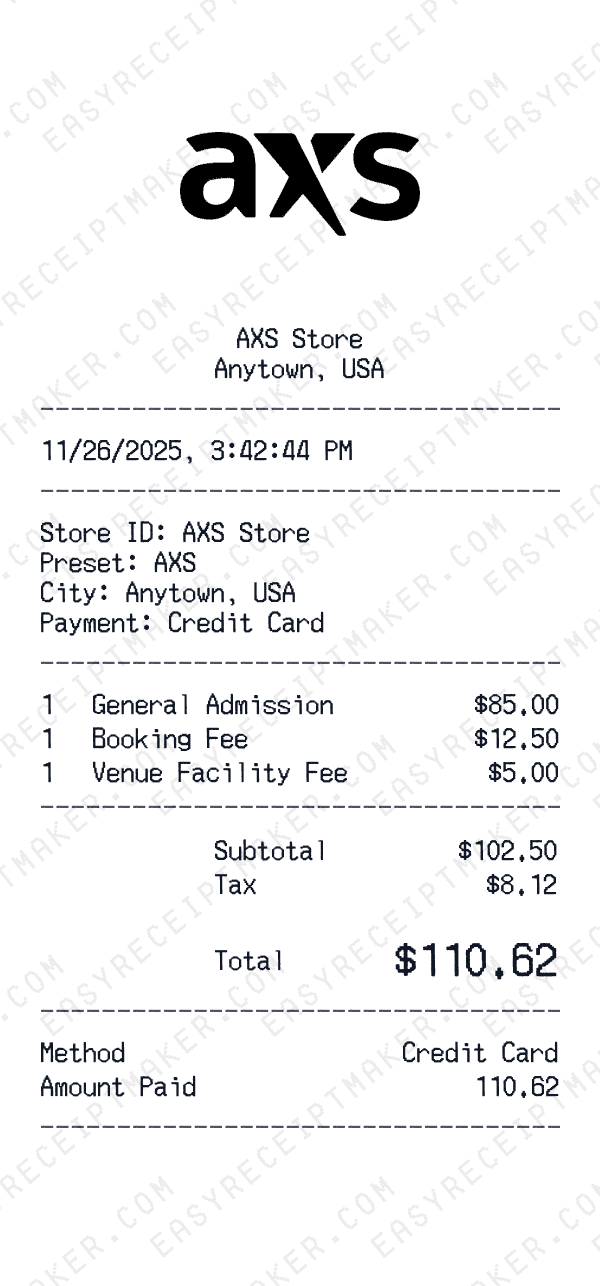

EasyReceiptMaker is designed for entertainment, creative projects, and personal use. Our receipt generator creates artistic mockups intended for film props, theater productions, escape rooms, party games, art projects, design mockups, and educational demonstrations. Generated receipts are creative works—not official financial documents.

We built EasyReceiptMaker to help creators, designers, and hobbyists produce realistic-looking receipt graphics quickly and easily. Whether you're designing a movie set, building an escape room puzzle, creating novelty gifts, or prototyping a point-of-sale interface, our tool provides the templates and customization options you need.

What EasyReceiptMaker is designed for

EasyReceiptMaker is a creative tool used for a wide range of fun projects. Film and TV productions use receipt mockups as props. Theater companies create realistic stage props. Escape room designers incorporate receipt puzzles. Party planners use novelty receipts for games and decorations.

Designers and developers also use EasyReceiptMaker for UI/UX mockups when building point-of-sale systems, expense tracking apps, or e-commerce platforms. Having realistic receipt templates speeds up the prototyping process without requiring real transaction data. Educators use receipt mockups to teach financial literacy, math concepts, or business operations in a safe, controlled environment.

Responsible use

EasyReceiptMaker is an online receipt generator for personal use, creative projects, and design mockups. Misuse for fraudulent activities is strictly prohibited.