Create realistic parking receipt props

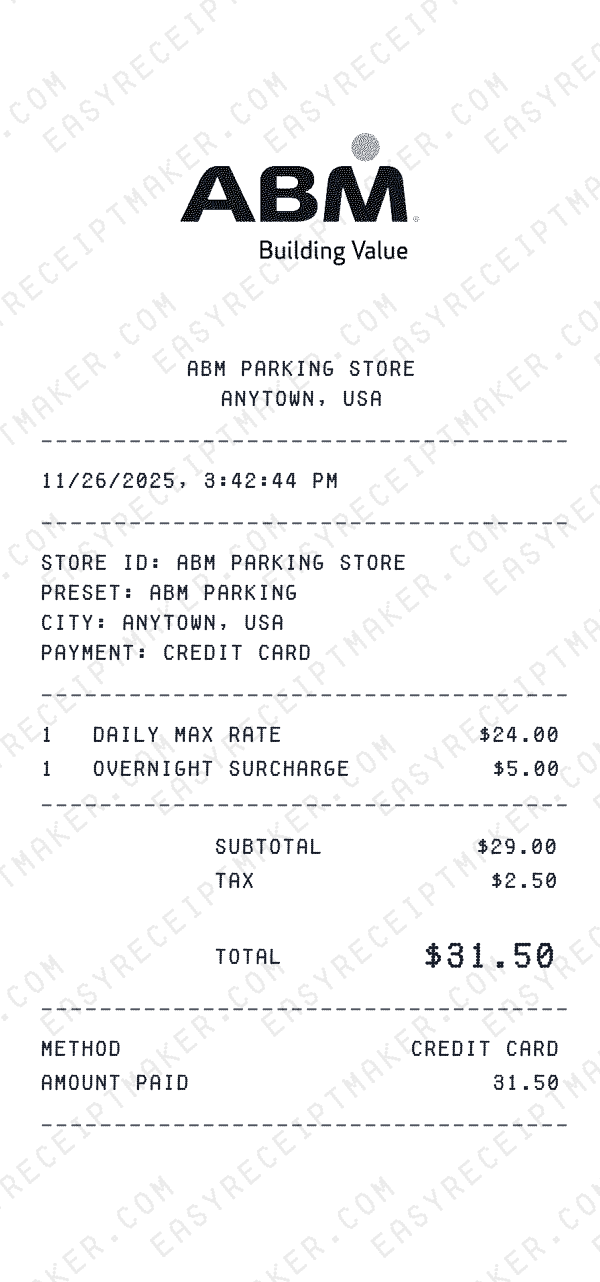

Need a parking receipt for your film production, theater set, or creative project? Our parking receipt template creates authentic-looking mockups with all the details audiences expect: parking facility name and location, date and time, duration, hourly or flat rate, and payment method. The generated receipt mirrors the format of real parking tickets and garage receipts, perfect for props, design mockups, and entertainment purposes.

Parking receipts are ubiquitous props in contemporary storytelling. A parking stub can establish a character's whereabouts, a garage receipt can provide a crucial clue in a mystery, or a stack of parking tickets can characterize someone's lifestyle. These small details add authenticity to modern-day scenes and settings.

How to create a parking receipt

Start by entering the parking facility name and address. Choose from garage formats (like LAZ Parking, SP+), surface lot styles, metered street parking zones, or airport parking formats. Create a fictional parking garage for your story or use a generic format for background props. Add the date and time of entry and exit to match your scene.

Now enter the parking rate and charges. For hourly parking, enter the rate and total hours. For flat-rate or daily parking, enter the flat fee directly. Add any taxes or service fees for realism. Download your parking receipt as a high-resolution image ready for printing or digital use in your production.

Popular uses for parking receipt mockups

Film and TV productions frequently need parking receipt props. A parking stub found in a character's pocket can reveal where they've been. A garage receipt with a timestamp can establish an alibi or break one. Airport parking receipts suggest travel. These props add layers of storytelling without dialogue.

Escape room designers use parking receipts as puzzle elements—the entry time might be a code, or the garage level could point to the next clue. Game developers and novelists use them for reference material. UI/UX designers create parking receipt mockups when prototyping parking apps, expense trackers, or smart city interfaces.

Customization options

Our parking receipt template offers extensive customization for your creative vision. Adjust all details including facility name, location, dates, times, duration, rates, and fees. Create fictional parking garages for your story or use generic formats that suggest any city. The thermal receipt styling gives that authentic crinkled-paper look.

For period-accurate productions, research parking rates from different eras and cities. A 1990s scene might show much lower rates, while contemporary downtown parking should reflect current premium pricing. These details add production value and immersion to your creative work.