Create realistic restaurant receipt props

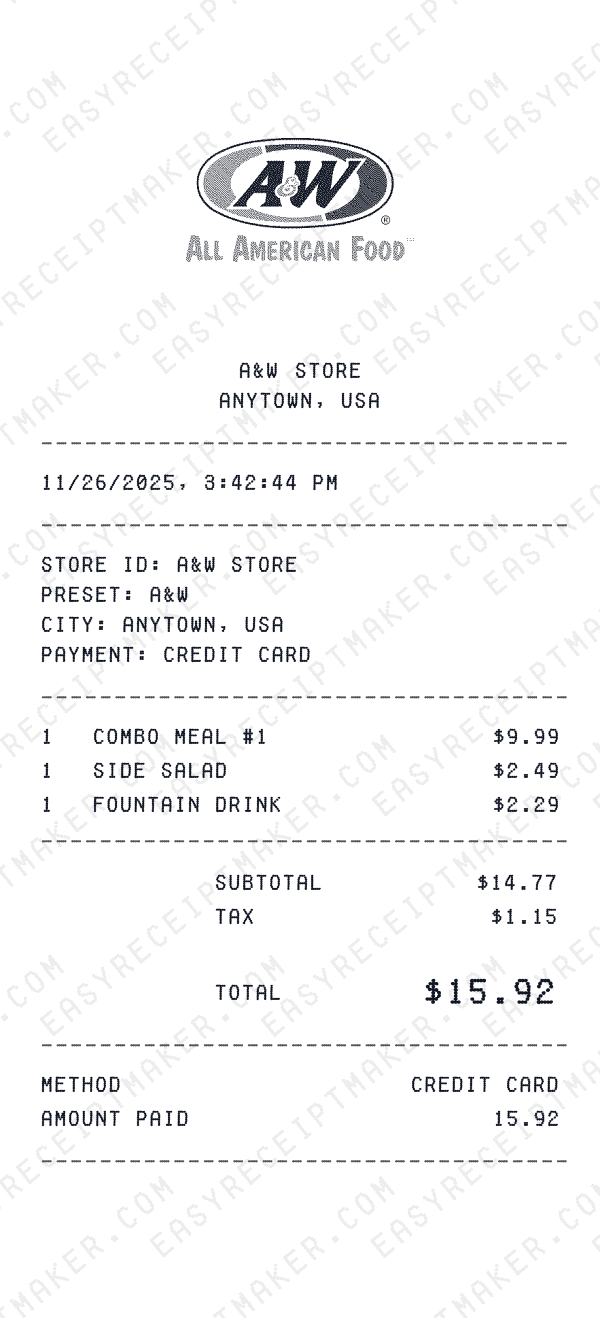

Need a restaurant receipt for your film production, theater set, or creative project? Our restaurant receipt maker creates authentic-looking mockups with all the details audiences expect: restaurant name and location, date and time, itemized menu items, subtotal, tax, tip, and payment method. The generated receipt mirrors the format of real restaurant bills, perfect for props, design mockups, and entertainment purposes.

Restaurant receipts are among the most recognizable everyday documents, making them ideal for adding authenticity to dining scenes. Whether you're creating props for a romantic dinner scene, designing an escape room with restaurant clues, or building realistic POS system mockups, our receipt generator provides the professional formatting you need.

How to create a restaurant receipt

Start by entering the restaurant name, address, and phone number. Choose from templates matching well-known chains like Olive Garden, Cheesecake Factory, or Chipotle, or create a custom independent restaurant bill for your fictional establishment. Add the date and time to match your scene or storyline.

Now itemize the menu items. List appetizers, entrees, desserts, and beverages separately with their individual prices. Add guest count for group dining scenes. Calculate sales tax based on realistic local rates (typically 6-10%). Enter the tip amount—usually 15-20% for full-service dining. Show the payment method and download your restaurant receipt as a high-resolution image ready for your production.

Popular uses for restaurant receipt mockups

Film and TV productions frequently need restaurant receipt props for dining scenes. A crumpled receipt on a table tells a story about the characters who just left. A close-up of a bill can reveal plot details—an expensive wine bottle, two desserts suggesting a date, or a business lunch at an upscale steakhouse. These small details add authenticity to storytelling.

Escape room designers use restaurant receipts as puzzle elements—the total might be a combination code, or itemized menu items could spell out a clue. Game developers and novelists use them for reference material. UI/UX designers create receipt mockups when prototyping restaurant POS systems, food delivery apps, or expense tracking software.

Customization options

Our restaurant receipt maker offers extensive customization for your creative vision. Adjust all details including restaurant name, location, date, menu items, prices, tax, and tip. Create fictional restaurant names for your story or use generic formats for background props. The thermal receipt styling gives that authentic look audiences recognize.

For period-accurate productions, research menu prices from different eras. A 1990s scene might show much lower prices, while a contemporary upscale restaurant scene should reflect current pricing. These details add production value and immersion to your creative work.