Create a receipt for your project

Need a receipt for a creative project or personal use? Whether you are designing a film prop, building a theater production, creating an escape room, or putting together a design mockup, having a receipt that looks authentic can bring your project to life.

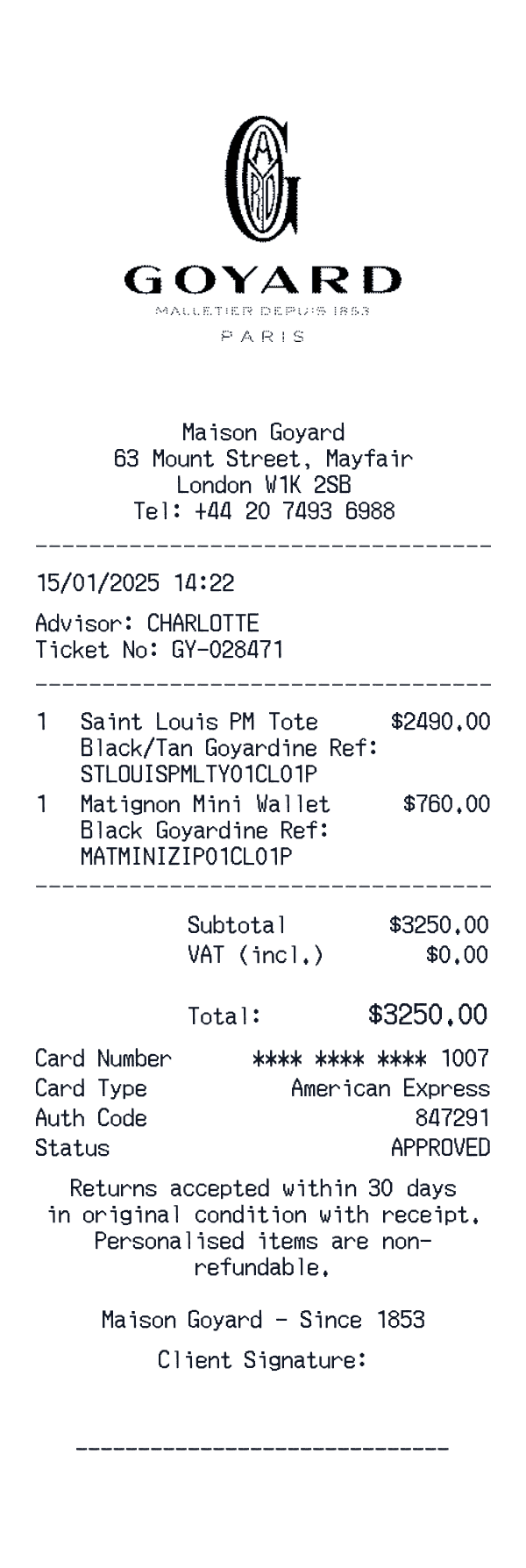

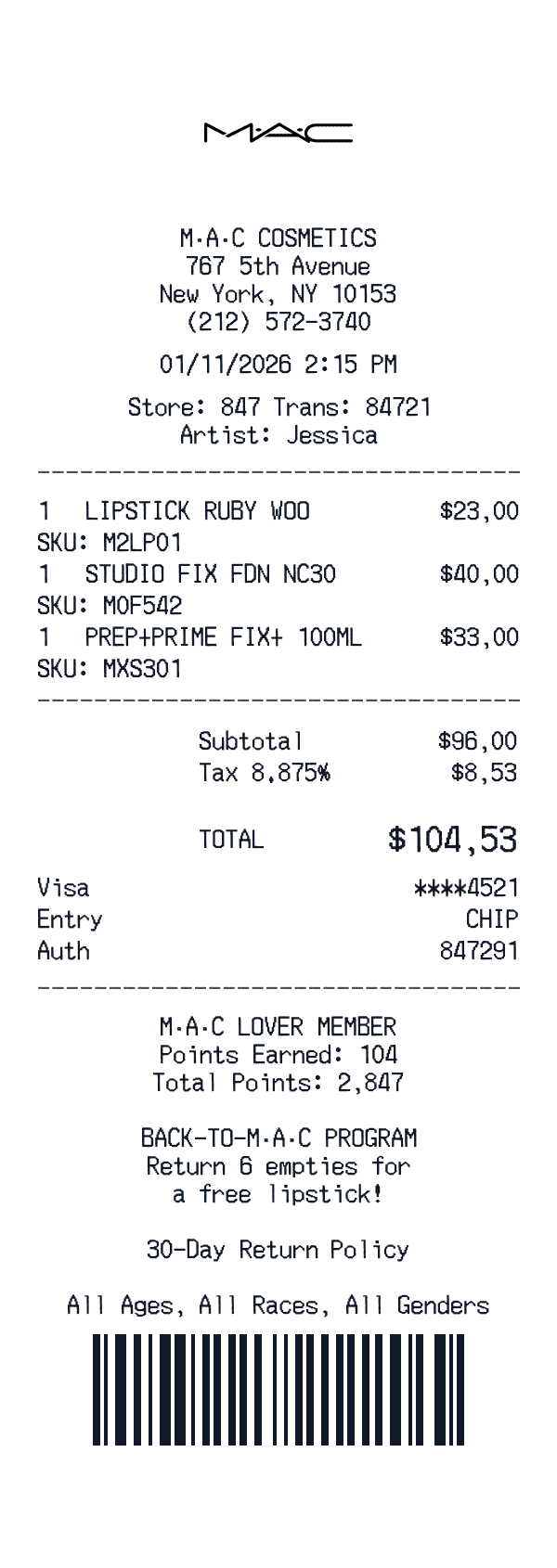

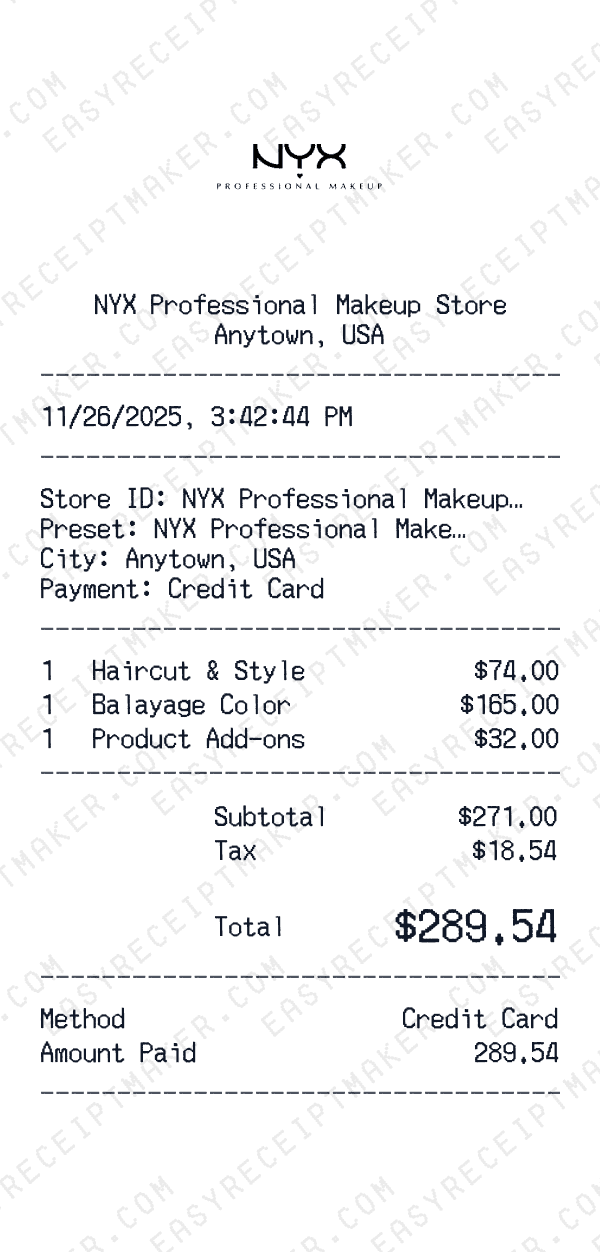

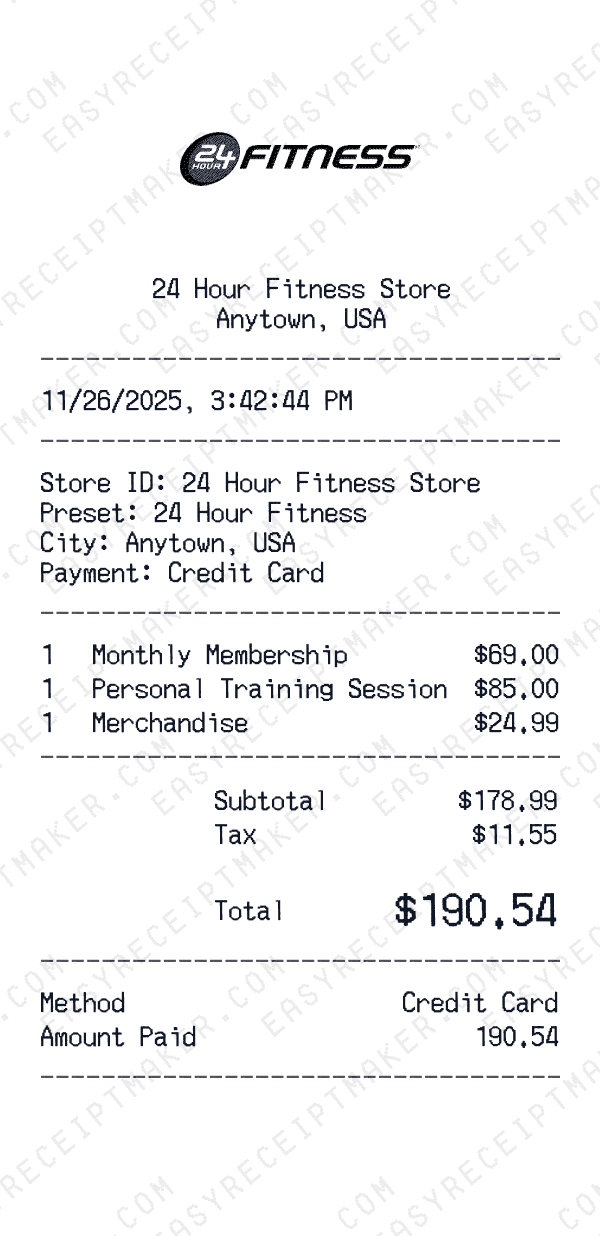

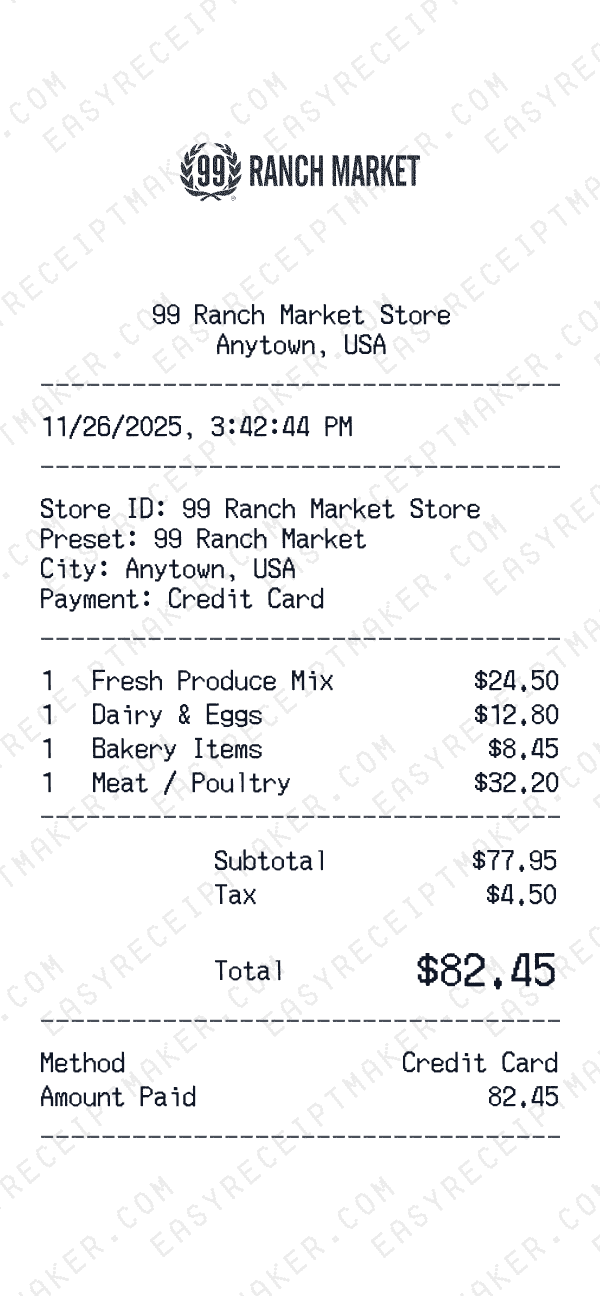

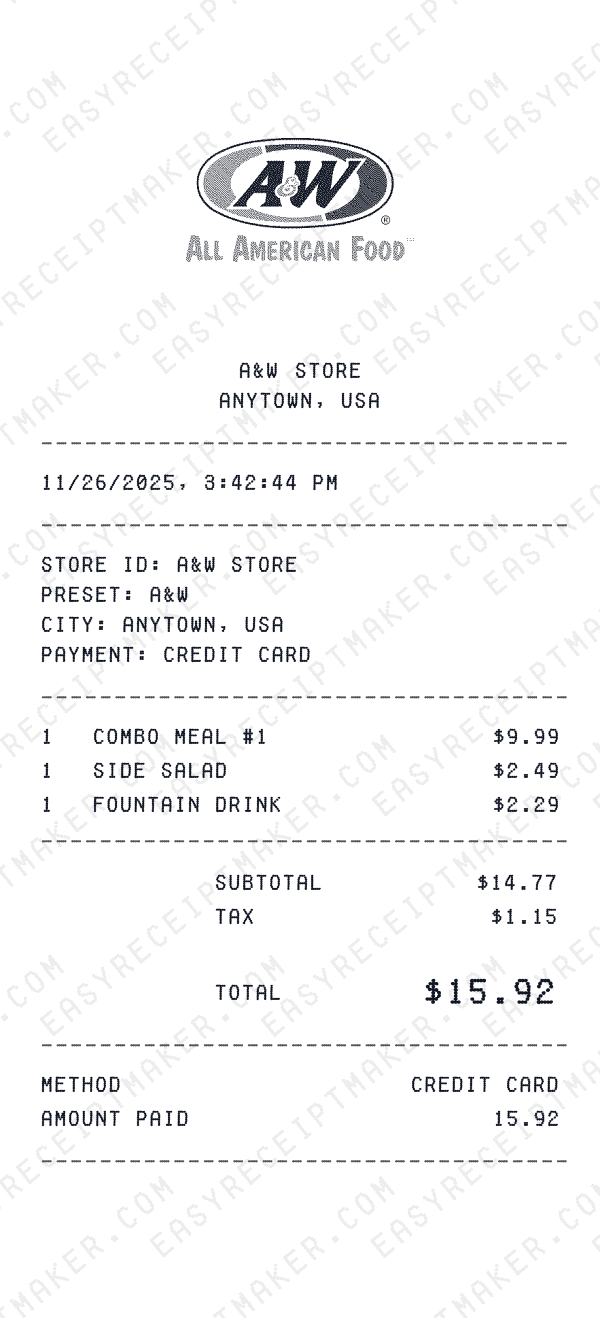

EasyReceiptMaker lets you create professional, detailed receipts in minutes. Our tool generates receipts that show the vendor, date, line items, taxes, and payment method—perfect for creative projects, design mockups, and personal use.

Instructions

1. Enter the store details: Start by adding the business name, address, and phone number. If you remember the store number or cashier ID, adding those details makes the receipt look even more authentic.

2. Add line items: List everything you purchased. Be specific—instead of just writing "Fuel," list "12 Gallons Regular Unleaded" and the price per gallon. If you bought office supplies, list "Printer Paper" and "Ink Cartridges" individually. Our tool allows you to manually enter subtotals and totals to match your records.

3. Set tax and payment info: Enter your local tax rate and the payment method you used (e.g., Visa ending in 1234). This ensures the final total matches your bank statement exactly.

Why detailed receipts matter

Our receipt generator is perfect for entertainment and creative projects like film props, theater productions, escape rooms, and design mockups. It's also useful for personal organization and keeping track of your purchases. The detailed itemization provides a complete picture of each transaction.

This tool is designed for creative and entertainment purposes. Use it to generate receipt designs for your projects, whether that is a short film, a game, a training exercise, or a UI/UX prototype.

Once you are finished, you can download your receipt as a high-quality PNG image. The layout, fonts, and spacing are designed to mirror standard point-of-sale systems, ensuring your receipt looks professional and fits seamlessly into your creative project.