Parking Receipt Templates

Generate parking receipts with entry/exit times, rates, and validation details. Perfect for creative projects, personal travel records, and event parking documentation.

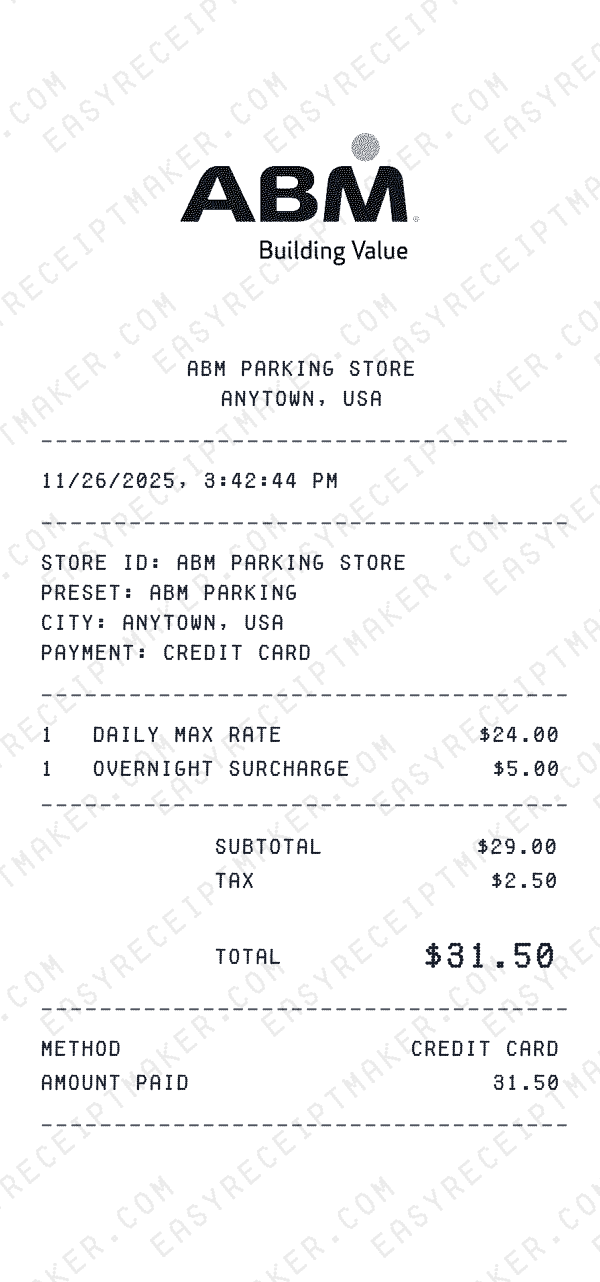

ABM Parking

Parking Garage Receipt

Diamond Parking

Parking Garage Receipt

Impark

Parking Garage Receipt

LAZ Parking

Parking garage receipt

Park America

Parking Garage Receipt

ParkWhiz

Parking reservation receipt

PayByPhone

Parking Garage Receipt

Propark Mobility

Parking Garage Receipt

Republic Parking

Parking Garage Receipt

SP+ Parking

Parking Garage Receipt

SpotHero

Parking Garage Receipt

Complete Guide to Parking Receipts

Parking receipts are commonly needed documents for creative projects, personal travel records, and budget tracking. Our parking receipt templates cover various parking scenarios including airport long-term parking, downtown garage parking, meter receipts, valet parking, and event venue parking. Parking receipts have specific elements that differ from other transaction receipts — they show entry and exit times, hourly or daily rates, parking space or level numbers, and validation stamps or codes. Our templates accurately capture the thermal paper format, gate ticket styling, and the specific rate calculations that parking facilities use including early bird specials, lost ticket fees, and validation discounts. Perfect for film props, app design mockups, and personal records.

Best Practices

- •Include entry and exit date/time stamps — parking receipts always show duration for rate calculation

- •Show the rate type (hourly, daily, flat rate, event) and how the total was calculated

- •Add the parking location details (lot name, address, space number, level) for proper documentation

- •Include validation information if the parking was discounted by a merchant or venue

Common Mistakes to Avoid

- •Not showing the full duration calculation (entry to exit) that determines the charge

- •Forgetting to include the parking location address that real parking receipts always display

- •Omitting the tax line that parking facilities typically include on receipts

About These Templates

Parking receipts are useful for creative projects, travel documentation, and personal creative projects. Our templates feature standard parking receipt formatting for professional documentation.

Parking Receipt Template Guide

Detailed guide with benefits, use cases & FAQs

Create Custom Parking Receipt

Build from scratch with our free generator

Parking Receipt Examples

Browse receipt examples with sample items & prices

Parking Receipt Resources

Related Receipt Tools

All Parking Receipt Templates

Missing a parking template?

Let us know which store or receipt you need — we add new templates every week!

Request a TemplateRelated Receipt Categories

Looking for something similar to parking receipts? Try these related categories.